If you think of the expression”fixed income,” you probably think of retirees. In the end, people in retirement are usually relying upon Social Security benefits, which can be set by specific formulas, and on required minimum distributions from retirement accounts. But there is a lot more flexibility to retirement earnings than you may think. Here are 10 ways that you can increase your income in retirement — with a few requiring action today and some later.

1. Raise Your savings and investing now

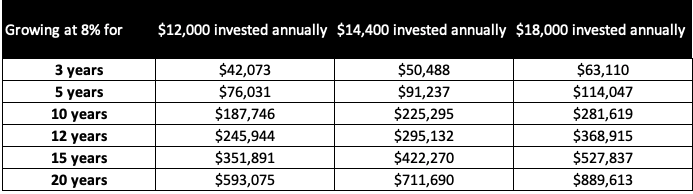

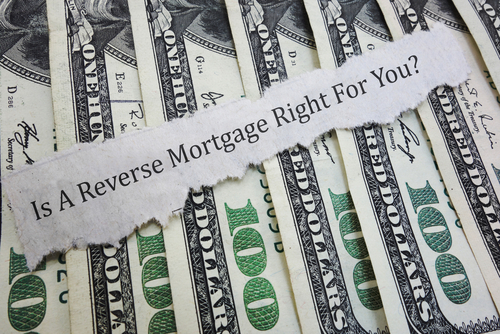

Beef up your Saving and investing and the difference it could make will surprise you. Imagine, for example, that you believe you’re doing pretty well saving $1,000 a month for your retirement. But if you could sock away $1,200 or $1,500 instead, that would amount to $14,400 or $18,000 annually instead of your current $12,000. Here is how much you could accumulate with those sums:

The table shows that if you are just a decade from Retirement, fostering your savings from $1,000 per month to $1,500 a month might net you near $94,000 more by retirement.

Growing your savings by that much can seem a tall order, though. You might have to strategize and plan about how to achieve it. Skipping a costly fancy coffee drink daily isn’t a new notion, but it’s saving you perhaps $3,000 annually. Cut the cable cord and only stream your video entertainment and you may save $50 a month or $600 per year. If you are paying $50 per month for a gym membership that you don’t utilize, canceling it can save another $600 annually. Make a few phone calls to auto and home insurance companies and you may find much better deals than you have now, devoting hundreds of dollars in savings annually. If you smoke, think about the financial benefit of quitting. Though, not an easy process, it can probably save you thousands of dollars annually.

2. Work a few more decades

Working a little longer than you might ideally wish to is another effective strategy. It not only assists your retirement accounts (s) grow invisibly but in addition, it means there’ll be fewer years that your nest egg has to support you. You might enjoy your employer-sponsored Medical Insurance for a few additional years, too.

The chart demonstrates what would happen if you plan to retire in 10 years. The table suggests how much you could amass between now and then — and in addition, it shows what you could have after 12 years and 15 years. If you can sock away $1,000 a month for a decade, it may rise to $187,746, however in the event that you can hang in there for another 2 decades, you’re looking at $ 1,000 245,944 — a gap of nearly $60,000!

3. Work somewhat in retirement

Another strategy would be to operate just a little at retirement, possibly for the first couple of years. Working only 12 hours per week at $10 per hour will generate roughly $500 a month in extra income. If you can work a couple more hours or may earn a higher commission, you are going to collect even more.

A part-time job can also give your times more structure and routine opportunities for interacting — things that many people find they actually miss.

4. Consider dividend-paying stocks

You can generate income by selling shares of stock from the stock portfolio over time — but using dividend-paying stocks, you can collect income without having to sell any shares! A $400,000 portfolio, as an instance, that sports an overall average yield of 3% will create about $12,000 per year — a strong $1,000 monthly. Dividend income is not guaranteed, but if you spread your money across a bunch of healthy and growing businesses, you’re likely to receive normal payments. Better still, companies tend to raise their dividend payments punctually, and that can help your earnings maintain inflation.

A Dividend-focused exchange-traded fund (ETF) can be quite a nice choice, also. Preferred stock is another way to go. The iShares U.S. Preferred Stock ETF (PFF) recently afforded 5.6%.

5. Contemplate annuities for pension-like income

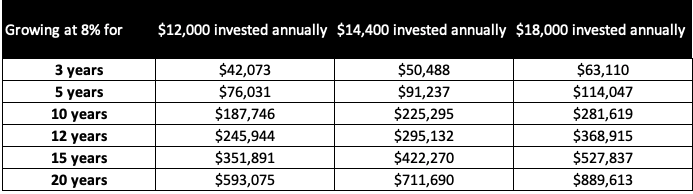

You may not have a retirement fund or pension, but an annuity or 2 can offer dependable pension-like income. It is true that a few annuities, such as variable annuities and indexed annuities, may be rather problematic, frequently charging steep fees and sporting restrictive terms. There are much simpler tools that may start paying you immediately or on a deferred basis.

Below are examples of the sort of income that various people might be able to secure through a direct fixed annuity in the present financial environment. (You will typically be provided higher payments if interest rates are higher.)

A deferred annuity could also be useful. It begins to cover you in the future. A 60-year-old man, for example, could pay $100,000 for a mortgage which will start paying him $1,037 per month for the remainder of his life starting at age 70. Deferred annuities are a good method to avoid running out of money late in life.

6. PRODUCE INCOME FROM INTEREST PAYING INSTRUMENTS

This Retirement income strategy of collecting earnings from interest-paying investments — isn’t very powerful within our low-interest-rate environment. But rates seem to be on the upswing, so it can be well worth contemplating today or in the coming years. At this time, if you park $100,000 in certificates of deposit spending 3% in interest, you’ll collect $3,000 annually, barely a very helpful sum. Back in 1984, though, prices for five-year, one-year, and six-month CDs have been in the triple digits. If you were able to earn 10 percent on a $100,000 investment, you’d enjoy $10,000 annually, equal to about $830 a month. (Inflation has dropped about 3 percent over several decades.) This could be a solid increase in income.

Bonds are an Attractive interest-paying alternative, too, but the safest ones (in the U.S. government) tend to pay modest rates of interest, especially in low-interest rate surroundings. Nonetheless, in case you’ve got a lot of cash, you might make this strategy work by buying an assortment of bonds which will mature at various times, generating earnings and increasing income over several decades.

7. IS A REVERSE MORTGAGE RIGHT FOR YOU?

In a reverse mortgage, you basically get a loan from a creditor, often in the form of monthly (tax-free) payments throughout your retirement, together with your home as the security. The loan does not have to be paid back until you do not reside in your home. That can seem great, but note that reverse mortgages do have a few downsides, like requiring your heirs to sell your house unless they can afford to pay back the loan. Still, if you will need the income and nobody is counting on inheriting your home, this can be a good retirement income strategy. It is important to learn far more about reverse mortgages prior to getting one. It may another way of increasing income.

8. MOVE. RELACOTE TO A LESS EXPENSIVE AREA.

Relocating is also a strategy worth considering. You could just downsize and move to a smaller house — or you can move to a region with lower taxation or even a lower cost of living. In any event, you may wind up spending less taxes, insurance, home maintenance, utilities, landscaping, etc. The median house value in California, by way of example, was recently about $409,300, but it was just $224,600 in Utah and just $157,100 from North Carolina. Although this may not Increase Income, it will lower expenses.

9. Borrow against your life insurance policy

Here’s a Strategy that does not happen to many people: If you’ve got a life insurance policy which nobody is depending on — such as if the children you meant to shield with it are now grown and are not dependent of yours — you might consider borrowing against it. This may work if you’ve purchased”permanent” insurance like whole life or universal life, rather than term life insurance that normally only lasts as long as you are paying for it. You’ll be reducing or wiping out the worth of the policy by means of your withdrawal(s), however when no one really needs the ultimate payout, it can make sense. Plus, the earnings is typically tax-free. This is another way of Increase Income.

10. Make the most of Social Security

Ultimately, know that the advantages you will ultimately accumulate are not set in stone. There are ways that you could boost your Social Security benefits. By way of instance, for each and every year past your full retirement age which you delay beginning to collect benefits, they will grow by about 8 percent. Delay from age 67 to 70 and you’ll increase your benefits by 24%. It is not quite as strong as it appears, though, because while your tests will be bigger, you’ll be amassing much fewer of these. Read up on spousal strategies, too, because coordinating when you and your other half begin collecting can help you both.

Do not assume Your retirement income will be fixed. Taking some actions today and applying some strategies can provide you much more cash to live from on your golden years.

The 16,728 Social Security bonus many retirees fully overlook

If you’re like many Americans, you’re a few years (or more) behind In your retirement savings. However, a handful of “Social Security Secrets” can help ensure a boost in your retirement income. As an example: One simple trick can pay you as much as $16,728 more… each year! Once you Find out how to maximize your Social Security benefits, we think you can retire confidently with the peace of mind we are all after. Simply click here to find out how to Find out More about These strategies.